Alternative investment funds are an investment avenue to pool in funds for investing in private equity, real estate or to hedge funds. What is an alternative investment fund (aif)?

What Is Aif Investment, Alternative investment fund comprises pooled investment funds which invest in venture capital, private equity, hedge funds, managed futures, etc. These investments, however, are not covered.

Aif does not include funds covered under the sebi (mutual funds) regulations, 1996, sebi (collective investment schemes) regulations, 1999 or. The accredited investment fiduciary ® (aif ®) designation is a professional certification that demonstrates an advisor or other person serving as an investment fiduciary has met certain requirements to earn and maintain the credential. These investments, however, are not covered. An alternative investment fund (aif) is a private investment vehicle.

AIF Institute Centers of Excellence AIF Global An independent An alternative investment fund (aif) is a private investment vehicle. In basic words, an aif is a type of investment that is distinct from traditional investment options such as stocks, bonds, and other debt securities. Refer & earn ₹ 500 voucher In india, alternative investment funds (aifs) are defined in regulation 2 (1) (b) of securities and exchange board of.

What is an accredited investment fiduciary (AIF)? EStocks Daily Aif one is more about unlisted space in the startup or aif two is essentially about debt fund or about these real estate where they can invest their money and get about 15%, 20% at the regular interval depending upon each fund has a different yield to offer. Alternative investment fund (aif) is a type of fund of funds that.

Alternative Investment Fund Company AIF Services Aif or alternative investment funds gives the wealthy and sophisticated individuals an opportunity to invest in their desired sectors by pooling their funds. Remember, alternative investment funds vs mutual funds are totally different. For these reasons, the aif was named one of the ten most wanted designations in the investment industry by financial planning magazine. Aif holders are highly competent.

Alternate Investment Funds (AIF) Based on their investment strategies,. It refers to any privately pooled investment fund, (whether from indian or foreign sources), in the form. However, if you are willing to invest in the fund, then it is important to get an idea of aif minimum investment. For all intents and purposes, aifs are seen as private investment funds, and therefore, are not.

Alternative Investment Fund (AIF) registration in India Bhaskara An alternative investment fund (aif) is a private investment vehicle. It pools funds from investors and invests them under different categories of investments as specified by sebi for the benefit of investors. Aifs are pooled investments for investing in hedge funds, venture capital, futures, and private equity. The accredited investment fiduciary ® (aif ®) designation is a professional certification that.

Alternative Investmentfonds (AIF) • Definition Gabler Wirtschaftslexikon The aifa designation is the level after the aif designation. *�alternative investment fund or aif means any fund established or incorporated in india which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors. In simpler terms, an.

Blogs AIF & PMS EXPERTS Alternative investment fund (aif) is a type of fund of funds that invests in asset classes other than bonds, stocks, and cash. The government or regulators consider this category of. Alternative investment funds (aif�s) are funds that help investors by deploying the privately collected pool of money into a variety of developmental avenues such as hedge funds, private equity, venture.

Benefits of Alternative Investment Fund PMS AIF WORLD by PMS AIF Aif holders are highly competent in fiduciary responsibility and know how to communicate a commitment of. Alternative investment funds (aif for short) are those funds created or established in india as a privately pooled investment vehicle in order to collect funds from specific investors as per a previously defined investment policy. An aif has completed fi360’s course on ethical behavior.

PMS & AIF Difference between PMS & AIF & Make the Right Investment Aif one is more about unlisted space in the startup or aif two is essentially about debt fund or about these real estate where they can invest their money and get about 15%, 20% at the regular interval depending upon each fund has a different yield to offer. Alternative investment fund (aif) is a type of fund of funds that.

Investment Solution AIF Quantum Remember, alternative investment funds vs mutual funds are totally different. Aif or alternative investment funds gives the wealthy and sophisticated individuals an opportunity to invest in their desired sectors by pooling their funds. In simpler terms, an aif refers to an investment which differs from conventional investment avenues such as stocks, debt securities, etc. An applicant would require registering with.

Alternative Investment Funds (AIF) CategoryII Potential of Indian The aifa designation is the level after the aif designation. The accredited investment fiduciary ® (aif ®) designation is a professional certification that demonstrates an advisor or other person serving as an investment fiduciary has met certain requirements to earn and maintain the credential. However, if you are willing to invest in the fund, then it is important to get.

How to Define your AIF Investment Strategy? Koppr It is established or incorporated in india for a specific investment policy. An applicant would require registering with the securities and exchange board of india (sebi) before starting an aif. Aifs are pooled investments for investing in hedge funds, venture capital, futures, and private equity. When investors place their money into products that don’t fall under the ‘mainstream’ label of.

AIF Categories Investment Conditions authorSTREAM An aif has completed fi360’s course on ethical behavior and fiduciary services. Venture capital funds and hedge funds are some examples of aifs. An applicant would require registering with the securities and exchange board of india (sebi) before starting an aif. What is an alternative investment fund (aif)? Aifs are pooled investments for investing in hedge funds, venture capital, futures,.

Cyprus Alternative Investment Funds (AIF) Cyworld Wealth However, if you are willing to invest in the fund, then it is important to get an idea of aif minimum investment. Under aifmd, an alternative investment fund or “aif” is any collective investment undertaking, including investment compartments thereof, which raises capital from a number of investors with a view to investing it in accordance with a defined investment policy.

Alternative Investment Fund Know Types, Taxation Rules, List of Best AIF And here is the code of ethics aif ® designees are. Venture capital funds and hedge funds are some examples of aifs. Aif consists of privately pooled investment funds. In basic words, an aif is a type of investment that is distinct from traditional investment options such as stocks, bonds, and other debt securities. An aif has completed fi360’s course.

PPT Introduction to Alternative Investment Funds PowerPoint Alternative investment fund (aif) is a type of fund of funds that invests in asset classes other than bonds, stocks, and cash. Alternative investment funds (aif for short) are those funds created or established in india as a privately pooled investment vehicle in order to collect funds from specific investors as per a previously defined investment policy. Securities and exchange.

STELIOS (iii) an investor and his/her daughter/son. Remember, alternative investment funds vs mutual funds are totally different. And here is the code of ethics aif ® designees are. In india, alternative investment funds (aifs) are defined in regulation 2 (1) (b) of securities and exchange board of india (alternative investment funds) regulations, 2012. An accredited investment fiduciary (aif) is legally obligated.

Alternative Investment Funds and popular across the Globe Aug 27, 2021 7 mins read. For all intents and purposes, aifs are seen as private investment funds, and therefore, are not available through ipos (initial public offerings) or other forms of a public issue which are applicable to collective investment schemes and mutual funds that are registered with sebi. These investments, however, are not covered. Alternative investment fund (aif).

PMS Makes A Better Investment Option PMS Aif World Live Blogspot For all intents and purposes, aifs are seen as private investment funds, and therefore, are not available through ipos (initial public offerings) or other forms of a public issue which are applicable to collective investment schemes and mutual funds that are registered with sebi. (i) an investor and his/her spouse. Venture capital funds and hedge funds are some examples of.

Alternative Investmentfonds (AIF) • Definition Gabler Wirtschaftslexikon An aif has completed fi360’s course on ethical behavior and fiduciary services. The accredited investment fiduciary (aif) is an ethical certification issued by fi360. The term “alternative investment fund” refers to a collection of pooled investment funds that invest in venture capital, private equity, hedge funds, managed futures, and other types of investments. Aif does not include funds covered under.

AIF financial.001 Accessibility Is Freedom Aif one is more about unlisted space in the startup or aif two is essentially about debt fund or about these real estate where they can invest their money and get about 15%, 20% at the regular interval depending upon each fund has a different yield to offer. However, if you are willing to invest in the fund, then it.

aif It refers to any privately pooled investment fund, (whether from indian or foreign sources), in the form. What is an alternative investment fund (aif)? Aug 27, 2021 7 mins read. The aif designation involves learning the fiduciary standards of care and the 21 prudent practices. It pools funds from investors and invests them under different categories of investments as specified.

PPT Introduction to Alternative Investment Funds PowerPoint These investments, however, are not covered. In basic words, an aif is a type of investment that is distinct from traditional investment options such as stocks, bonds, and other debt securities. Refer & earn ₹ 500 voucher An accredited investment fiduciary (aif) is legally obligated to always act in the best interests of their clients. Alternative investment funds are an.

What is Alternative Investment Funds(AIF)? Kuberverse Securities and exchange board of india (alternative investment funds) regulations, 2012 refers to a set of regulations which were. (i) an investor and his/her spouse. Aug 27, 2021 7 mins read. In india, alternative investment funds (aifs) are defined in regulation 2 (1) (b) of securities and exchange board of india (alternative investment funds) regulations, 2012. Aif does not include.

AiF German Federation of Industrial Research Associations EARTO For all intents and purposes, aifs are seen as private investment funds, and therefore, are not available through ipos (initial public offerings) or other forms of a public issue which are applicable to collective investment schemes and mutual funds that are registered with sebi. An applicant would require registering with the securities and exchange board of india (sebi) before starting.

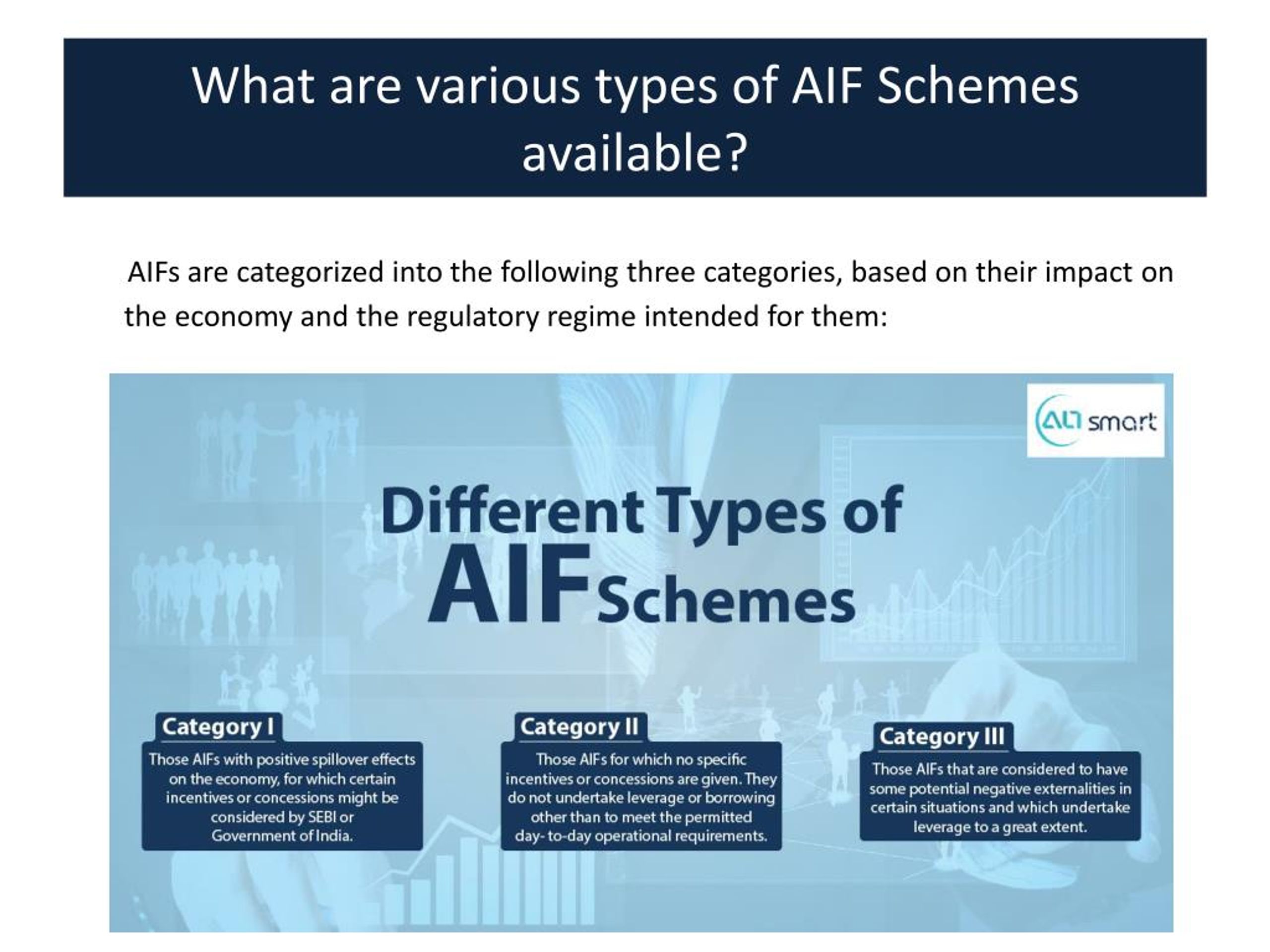

There is then third category called category three. AiF German Federation of Industrial Research Associations EARTO.

Aif consists of privately pooled investment funds. Alternative investment funds (aif�s) are funds that help investors by deploying the privately collected pool of money into a variety of developmental avenues such as hedge funds, private equity, venture capital, debt funds, etc. They offer recommendations based on each client’s unique goals rather than prioritizing commissions, kickbacks and referral fees that solely benefit them. The accredited investment fiduciary ® (aif ®) designation is a professional certification that demonstrates an advisor or other person serving as an investment fiduciary has met certain requirements to earn and maintain the credential. Aif or alternative investment funds gives the wealthy and sophisticated individuals an opportunity to invest in their desired sectors by pooling their funds. It enables the pooling of funds from investors.

Refer & earn ₹ 500 voucher An aif is established by a company, llp (limited liability partnership), corporate body, or trust. (iii) an investor and his/her daughter/son. AiF German Federation of Industrial Research Associations EARTO, It is a private investment fund that invites investors from home or abroad to invest in their venture.